Good Advice To Deciding On Credit Card Apps

Wiki Article

How Do I Determine Whether My Credit Card Has Been Reported Stolen In The United States?

If you want to determine whether your credit/debit card was reported stolen in the USA Follow these steps: Contact the credit card issuer-

Contact the customer support phone number, which is printed on the backside the card.

Inform the agent that you'd like to inquire about the status of your account and, if it has been claimed as lost or stolen.

You will be asked to prove your identity by providing personal information and credit card details.

Check Your Online Account-

Log in to your online bank account or credit card associated with the card you are referring to.

Watch for alerts or notifications about your card's status.

Review recent transactions to find any suspicious or unauthorised transaction that is suspicious or unauthorized.

Monitor Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

Be aware of suspicious credit accounts or inquiries on your credit report which could indicate fraud.

Security Freezes and Fraud Alerts--

If you think there is a possibility of fraud or a identity theft, you should consider setting up a security freeze or a fraud alert on your credit report.

A fraud alert alerts creditors to the additional steps they should be taking to verify your identity prior to offering your credit. Meanwhile, a security freeze blocks access to your credit file.

Be on the lookout for any suspicious activity and be sure to report it.

Always keep an eye on your credit card statements and report any fraudulent transactions or suspicious transactions to the credit card company immediately.

Inform any suspicious cases of identity fraud or theft to the Federal Trade Commission (FTC) and file a report with your local law enforcement agency.

Contacting your bank, looking up your account's history online, monitoring the status of your credit score, and remaining alert for any indications of unauthorized transactions or suspicious transactions, you can prevent fraudulent use of your credit card.

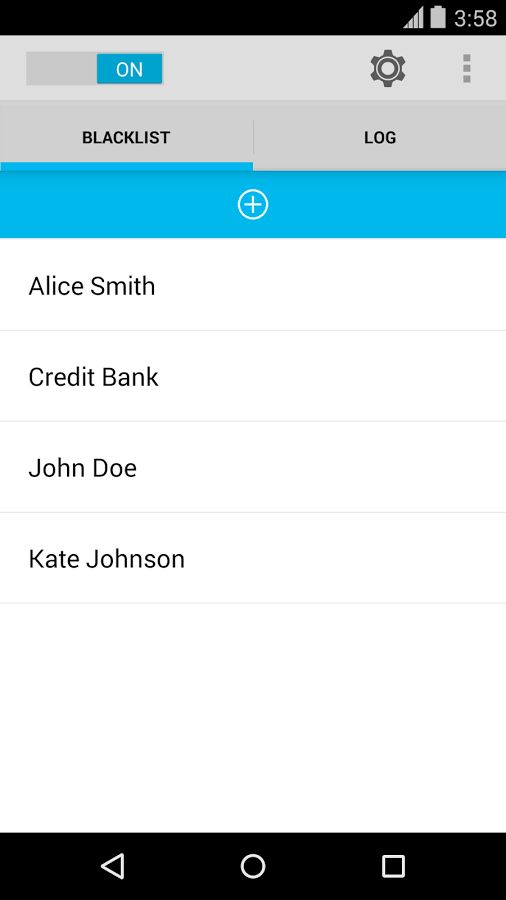

What Does It Mean For My Credit Card To Be On Blacklists?

Being on a Blacklist can limit the use of a card or transactions until the issue is addressed. There are many different reasons for why a credit card might be placed on a blacklist.

Card blocked for security reasons If you suspect fraud, your card could be blocked if it detects unusual or suspicious transactions.

Security Issues- If there are indications of possible breach for example, unauthorised access, data breach involving the card's details or unusual spending patterns The card may be considered a security risk.

Identity Verification Issues- Challenges in proving the identity of a cardholder when making transactions, particularly when additional verification is required, can lead to the card being temporarily blocked.

Card Stolen or Lost If a credit card has been reported stolen or lost, the issuer may put a stop to misuse of the card until a replacement is issued.

Suspicious Activity Identifiers- Any behavior or activity connected to the card is suspicious, such as numerous declined transactions, geographical anomalies, or other unusual spending patterns, may trigger temporary block.

If a card is listed on a blacklist cardholder's access to credit or the ability to use the card to make transactions could be restricted until the issuer confirms the authenticity of the card, or settles any concerns regarding potential security or fraud. It's crucial for the owner of the card to contact the issuer promptly to address the issue, validate transactions, and resolve any security concerns that may be related to the card.

Cybersecurity Experts Are Educated To Detect And Monitor Cyber-Attacks, Including Credit Card Data.

Security professionals monitor and detect security threats like stolen credit card numbers with a variety of techniques and tools. Some of the most commonly used strategies and methods are: Threat Intelligence Gathering

Collecting information through diverse sources, such as forums such as dark-web monitoring, forums, feeds and security alerts to stay current on the latest threats and security vulnerabilities.

Network Monitoring and Intrusion Detection

Software and tools that monitor network traffic to spot anomalies, suspicious activity or other indicators of unauthorized access.

Assessment of vulnerability and Penetration Testing

Regular checks can help to identify weak points in the network, applications and systems. Testing for penetration involves the use of the use of simulated attacks to reveal vulnerabilities and assess the organization's security measures.

Security Information and Event Management, (SIEM),

Implementing SIEMs that combine log information and analyze it from different sources (such firewall servers and applications) in order to detect security incidents and react to them quickly.

Behavioral Analytics

Conduct a behavioral analysis to find unusual patterns or changes in user behavior, inside systems or networks. This could signal an underlying vulnerability.

Threat Hunting

Recognizing potential threats through analysis of logs as well as data traffic and the system's information.

Endpoint Security Solutions

Endpoint security tools (such as anti-malware, endpoint detection and reaction tools) are used to guard devices and their endpoints from criminal activities.

Encryption & Data Protection

Implementing encryption methods to protect sensitive information, such as credit card information during transport and at rest, in order to reduce the risk of data breaches.

Response to incidents and Forensics

To be able to respond swiftly to security breaches, it is important to establish and implement incident response plans. Conducting forensic analysis to investigate and understand the scope, impact, and causes of security incidents.

Security professionals from Cybersecurity combine these methods together with a thorough understanding of cyber risks and compliance rules, as well as best practices, to recognize and combat cyber-attacks. This includes incidents involving compromised card information. An active security strategy that is constantly monitored and threat intelligence are essential to ensure a solid cyber security. See the most popular savastan0 carding for site info.