Great Hints For Picking A Trade RSI Divergence

Wiki Article

Utilize Cleo.Finance To Trade Automatically RSI Divergence!

Divergence refers to the direction of an indicator and that of an asset change in opposite directions. Divergence between momentum indicators like the RSI or MACD is a powerful tool for identifying potential changes in an asset's direction. It is an essential component of many trading strategies. We are thrilled to inform you that you can now use divergence to create open and close conditions to your trading strategies with cleo.finance! Take a look at best forex backtest software for site examples including backtesting strategies, crypto trading backtester, backtesting, stop loss, automated forex trading, cryptocurrency trading bot, backtesting platform, trading with divergence, trading divergences, trading platforms and more.

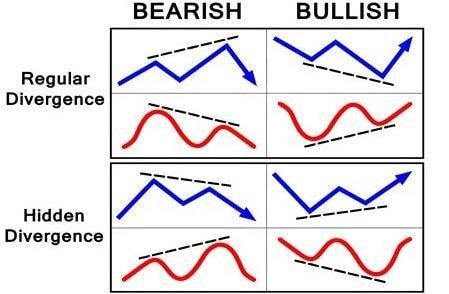

There Are Four Types Of Divergences.

Bullish Divergence

The price is printing at a lower low but the technical indicator shows higher lows. This indicates a weakening of the downtrend. It is possible that the upward trend will reverse.

Hidden Bullish Divergence

The oscillator is making lower lows, and it has higher lows. A bullish divergence that is hidden can suggest that an uptrend is likely to continue and can be found at the tail end of a price throwback (retracement down).

Hidden Bullish Divergence Explanation

Quick Notes

Bearish Divergence

While price is creating higher highs and technical indicators showing lower highs, this indicates that the price is making higher highs. This signalizes that momentum towards the upside is waning, and a reversal towards the downside could be expected to follow.

Bearish Divergence Explanation

Quick Notes

Hidden Bearish Divergence

The oscillator is making higher highs, and it has lower lows. An invisible bearish divergence, which could indicate that the downtrend will last, can be found at tail end of an upward pullback (retracement back).

Hidden Bearish Divergence Explanation

Quick Notes: watching price peaks during a drawback in a downtrend when price is first moving down

Regular divergences provide a reversal signal

The presence of frequent divergences may suggest that a trend may be about to reverse. These signals are a sign that the trend is strong but its momentum has dropped. It could be a warning sign of the possibility of changes in direction. Divergences are powerful entry triggers. See the best trading platform for more examples including automated crypto trading, trading platform cryptocurrency, forex backtesting software free, trading platform cryptocurrency, trading platform crypto, trading platform, best forex trading platform, backtesting trading strategies, position sizing calculator, crypto trading bot and more.

Hidden Divergences Signal Trend Continuation

Hidden divergences, on the other hand are indications of continuation that are most likely to be observed at the middle or the top of the trend. They signify that the current trend is likely to peRSIst after a pullback and are often powerful entry triggers when confluence evident. Trading professionals often use hidden divergences as a way to join an established trend after a drawback.

Validity Of The Divergence

The most popular use of divergence in a momentum indicator is with RSI (or Awesome oscillator) or MACD. These indicators are focused on the current trend and, therefore, trying to determine divergence that occurred over 100 candles back does not provide any predictive value. However, you can alter the indicator's time frame to increase the probability that there are legitimate divergences. It is important to take your time when determining if the divergence is legitimate. Some divergences are not valid.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- Follow the best best crypto trading platform for blog tips including RSI divergence, automated trading platform, automated trading software, forex backtesting software free, trading platform crypto, automated forex trading, backtesting trading strategies, cryptocurrency trading, position sizing calculator, crypto tradingand you can compare those divergences between two points:

Price With An Oscillator Indicator

An oscillator indicators with another oscillator indicator. The price of any asset, and the price of any other asset.

Here is a guide on how to use diveRSIons on cleo.finance builders

Hidden Bullish Divergence in Cleo.finance can help create open situations

Customizable Parameters

Divergences in all divergences can be customized further by traders with the help of four parameters that can be edited.

Lookback Range (Period)

This parameter controls how far back the strategy should be looking for divergence. The default value is 60. This is "Look for the divergence anyplace within the 60 bar interval that has passed"

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter defines how many candles on the left side must be lit to ensure that the pivot point has been discovered.

Confirmation bars (Pivot Lookback Right)

This parameter specifies how many bars need to be put on the right side to ensure that the pivot point has been placed. Read the top backtester for website examples including crypto trading backtester, forex backtester, RSI divergence cheat sheet, crypto trading bot, RSI divergence, divergence trading forex, stop loss, trading platform crypto, crypto trading backtester, backtesting tool and more.

Timeframe

You may define here the period of time during which the divergence should be observed. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

Differentgenes parameters settings in cleo.finance

Each peak/trough in the divergence is determined by the two pivot point settings. If you keep the default settings of an inverse bullish divergence:

Lookback Range (bars),: 60

Min. Distance between the troughs (left) is 1

Confirmation bars = 3

This means that the divergence troughs are to be within five bars of each other (less than 1 bar to the left or 3 bars to the left). This is the case for both troughs to be found in the past 60 candle candles (lookback period). The closest pivot point will confirm the divergence 3 bars after.

Available Divergencies In Cleo.Finance

The most popular uses are with RSI divergence and MACD divergence, but you can be sure that any oscillator is able to be examined and traded with the automated trading platform cleo.finance. See the recommended automated trading software for more examples including divergence trading forex, cryptocurrency trading, best forex trading platform, forex backtesting software, forex backtesting software free, crypto backtesting, trading platform crypto, trading platform cryptocurrency, crypto trading backtesting, software for automated trading and more.

In Summary

Divergences may help traders to add an important tool in their arsenal. But they shouldn't be utilized without cautious planning. This can help traders make better informed decisions when trading by using divergences. It is essential to approach divergences with a disciplined and strategic mindset. They can be paired with other kinds of fundamental analysis or technical such as Support and Resistance lines. Fib retracements and Smart Money Concepts can increase your conviction that the divergence is legitimate. Take a look at our Risk Management Guides on Stop loss location and size. With over 55 indicators for technical analysis including price action, candlesticks, and candle sticks data points you can instantly create your optimal divergence trade strategies. The cleo.finance website is constantly expanding. If you've got a suggestion to add an indicator or data point please let us know.